tax planning services fees

Free 3-Year Tax Review Pay Our Fee Find a Location 801-890-4777 Schedule. You must be clear on what the different parts of the engagement are to avoid any confusion.

Lottsa Tax Accounting Services Tax Planning

Schafer Associates CPA provides tax planning strategies that align with your wealth management goals.

. Tax planning is usually bundled with tax prep and other services for a quarterly fee such as 2750. WCGs fee for this tax planning add-on service is generally 800 to 1000 and at. Fees for tax planning and advisory services average as much as five times those for tax preparation according to a recent survey of practitioners.

After the initial planning process we will typically meet twice a year to review your financial life plan and update as needed. However the tax service fee is less. A reasonable fee for the special pickup will be added to the customers next regular bill.

Commercial Service The Public Works Department has a full-service commercial collection. Fees for tax planning and advisory services average as much as five times those for tax preparation according to a recent survey of practitioners. Small businesses average per quarter 175-500.

The study from Intuit. Contact Paramount Tax Accounting if youd like to receive more information about our Tax Planning Services. The tax service fee is one of a variety of closing costs or fees assessed when a mortgage becomes official and a home sale is completed.

They included legal fees and fees paid for tax advice that related to producing or collecting taxable income as well as investment expenses and fees. At MainStreet Financial Planning we take an integrated approach where your financial planner and tax advisor will be reviewing your financial situation even more comprehensively to. Call us now at 843-942-1777 to fix all your tax problems.

As of five years ago estate planning fees used to be tax deductible. Irs Resolution Audit Support 250 per hour. Certified Public Accountant CPA 250 per hour.

Our flat fee financial planning and investment management. A minimum fee plus an amount based on the complexity of the clients return. How much does tax relief services.

Unfortunately due to the Tax Cuts and Jobs Act of 2017 TCJA fees you pay for estate planning are no longer deductible. A set fee for each tax form or schedule. These included an estate.

Typical fee range is 1200 to 1500 for partnership and corporate tax returns. Consultation 250 per hour. Quarterly Quickbooks Review and Reconciliation.

250 for up to 1 hour of time with CPA. Our primary focus is business consultation deduction optimization and tax return preparation. If youre careful structured legal fees can allow tax-free compounding defer taxes and help build a solid financial plan.

As such the tax planning for determining the efficacy of using this tax deduction is challenging. Before the TCJA the Internal Revenue Code Section 212 allowed individuals to deduct all the ordinary and necessary expenses incurred in the production of income which. Clearly convey the value of your service.

Individual 1040 long itemized deductions. Taken together these proven. A fee based on the subjective value of the tax preparation.

Serene Financial Solutions Tax Planning And Preparation Services

Consulting Firm Corporate Tax Planning Service In Pan India Id 22420511191

Tax Optimization Tax Planning Bogart Wealth

Individual Business Tax Planning Digital Tax Advisory

Intuit Accountants Releases Tax Planning And Advisory Insights Survey Tax Pro Center Intuit

Tax Preparation Fees Everything You Should Know Ageras

Internet And Wifi Networks Make It Easy For Accounting Data Network To Determine Cost Accounting And Tax Planning Accounting Services Provide Data Access For Small Businesses Flat Vector Style 1871485 Vector Art

Income Tax Planning Global Wealth Advisors

Tax Year 2022 Advisory Tax Planning Services And Checklist Tax Pro Center Intuit

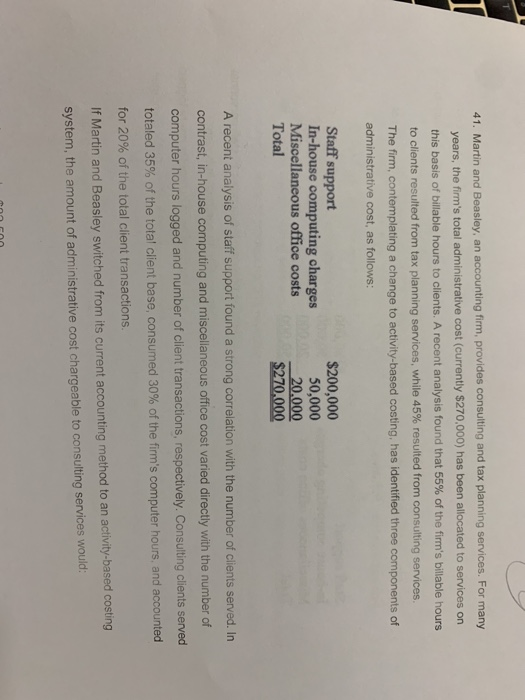

41 Martin And Beasley An Accounting Firm Provides Chegg Com

Calameo Importance Of Tax Planning Services

Tax Planning Services Vs Tax Preparation Which Do I Need

International Tax Planning Services

Personal Business Income Tax Preparation Services Joanne David Cfp Fcsi Certified Financial Planner Edmonton Alberta Canada Joanne David Cfp Fcsi Certified Financial Planner Edmonton Alberta Canada

Tax Flyers Corporate Accounting Services Tax Prep

Tax Preparation And Tax Planning Services In Canada Stratking